Evgenii Vladimirov

Erasmus University Rotterdam

iCOS: Option-Implied COS Method

The slides shown at the event can be found here.

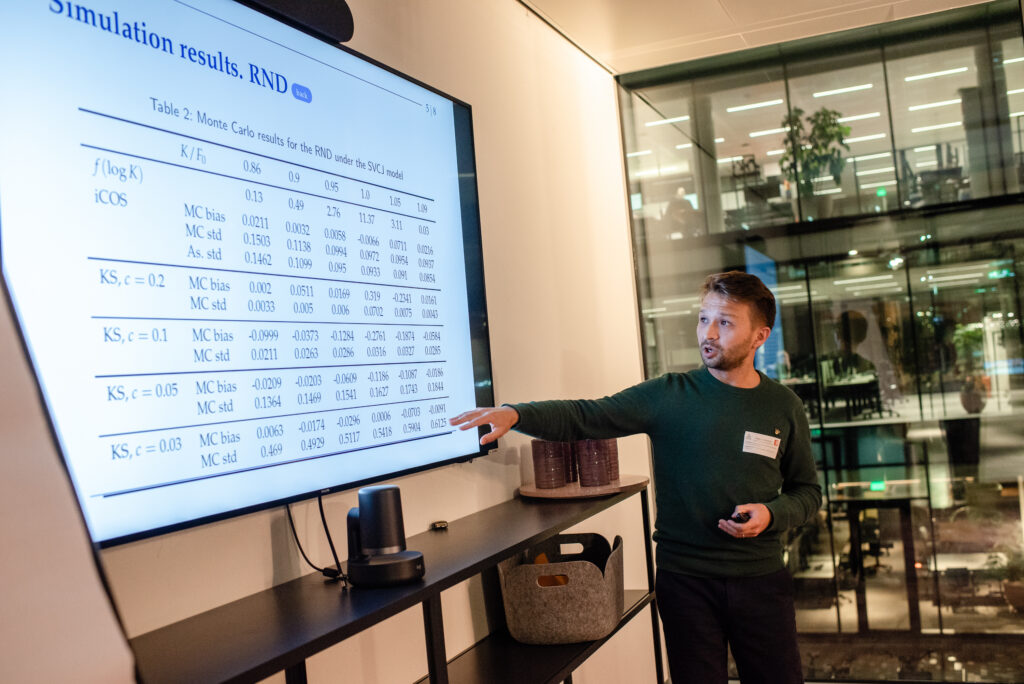

This paper proposes the option-implied Fourier-cosine method, iCOS, for non-parametric estimation of risk-neutral density, option prices, and option sensitivities. The iCOS method leverages the Fourier-based COS technique, proposed by Fang and Oosterlee (2008), by utilizing the option-implied cosine series coefficients. Notably, this procedure does not rely on any model assumptions about the underlying asset price dynamics, it is fully non-parametric, and it does not involve any numerical optimization. These features make it rather general and computationally very appealing. Furthermore, we derive the asymptotic properties of the proposed non-parametric estimators and study their finite-sample behavior in Monte Carlo simulations. Our empirical analysis using S&P 500 index options and Amazon equity options illustrates the effectiveness of the iCOS method in extracting valuable information from option prices in different market conditions.

Evgenii is an Assistant Professor at the Econometric Institute, Erasmus University Rotterdam. He completed his PhD in Financial Econometrics at the University of Amsterdam in 2023